Insights into Domestic Gas Prospectivity Onshore Germany

- Angeliki Temponera

- Sep 23, 2021

- 5 min read

Over the summer of 2021, 1st Subsurface provided three University of Aberdeen students with MSc projects. Focussing on the Southern Permian Basin, and using TROVE KnowledgeBases to inform their research, these projects were a great success.

Over the last few weeks our three students (Alexzandra, Queen & Angeliki) have been sharing their findings. We'd like to thank all three of the students for their hard work throughout and wish them all the best for their careers.

This week, Angeliki describes her project focussing on the Permian of onshore Germany.

If you would like to reach out to Angeliki, you can do so here: angelinatempo2@hotmail.com

From May 2021 to August 2021, I undertook my summer project as a requirement of my MSc at The University of Aberdeen. The project presents a comprehensive and systematic overview of the onshore gas exploration and production in the Southern Permian Basin area of Germany and was also meant to act as a reference to future geoscientists who will be interested in these fields. As, in Germany, there is no equivalent of the Oil and Gas Authority or Norwegian Petroleum Data data release agencies, the ultimate project goal was to stimulate the energy industry to continue their activities in the basin and break German taboos on shale gas.

Project challenges

The data collection for this study turned out to be much more complicated than expected, in particular regarding reservoir petrophysical/geological and hydrocarbon property data availability. The Southern Permian Basin gas province extends over Lower Saxony area, Nordrhein-Westfalen, Hamburg, Schleswig-Holstein, Sachsen-Anhalt, Brandenburg and Mecklenburg-Vorpommern. Lower Saxony area, containing 230 hydrocarbon fields and discoveries, has been the only area I managed to find high quality technical data on, therefore this project’s findings are based on Lower Saxony fields.

Reasons are:

1. Lack of openly available online publications, combined with pandemic-related limitations to travel in order to visit libraries.

2. The mining law in Germany allows confidentiality of data for almost indefinite times.

Exploration and Production History

Exploration began early on the onshore part of German Basin, with first discovery and first oil dating back to 1861. A first shallow gas discovery was made by chance in 1910 whilst drilling for water near Hamburg, but the first deep gas discovery, the Bentheim field, only followed in 1938. The same time intense drilling efforts in the former East Germany (GDR) resulted in a first gas discovery in 1964. Discoveries started predominantly after World War II and decreased rapidly after 1999.

Recently, discoveries are very limited onshore (only four between 2010-2020 and 2 between 2015-2020), but some large accumulations have still been proven (e.g., Römerberg, 2006, actually nearly doubled the Upper Rhine Graben resources).

Fields in Lower Saxony have predominantly Permian (120), Triassic (92) and Carboniferous (26) reservoir ages as shown in Fig.3

Fig 4. shows a more detailed breakdown, most of reservoir age showing the predominant ages Permian (49%), consisting of both Rotliegend sandstone and Zechstein dolomite reservoirs.

German domestic gas production commenced in the mid 1960’s and maintained a plateau rate of between 16-20 million cubic meters per annum through to ~2006. Since then, there has been a steady decline in production levels as discoveries have failed to replace production offtake.

Gas reservoirs

The major reservoirs in German Sector SPB are the Rotliegend sandstones and the Zechstein carbonates. There are also significant reserves in the Buntsandstein (Triassic) and Carboniferous sandstones, Middle Triassic, Malm (Jurassic), Dogger (Jurassic), Lias (Jurassic), Cretaceous and Tertiary oil fields account for associated-gas production in the region.

The majority of reservoirs are low permeability with only two fields having permeabilities greater than 500mD (Fig 7.) with no apparent pattern. Same applies for reservoir porosity where there is no large-scale-pattern with large porosity variations within individual reservoirs.

Unconventional resources

Germany can cover only 15% of its gas needs on its own. Most of the gas is imported from Norway, Netherlands and Russia. More specifically, Russia currently accounts for 38% of the Germans' total gas needs. The growth of shale gas extraction in Germany holds great promise in terms of increasing the country’s gas reserves and reducing its dependence on foreign energy sources. It is estimated that there is 226 Bcm of recoverable shale gas, which is less than Norway (2,350 Bcm) and Poland (526 Bcm) (Klaus Deuse, 2014), but still remains a significant number as it stands for about 3-20 times the German natural gas reserves. First projects on unconventional gas extraction began in 2007 in the most promising areas which were North Rhine-Westphalia and Lower Saxony.

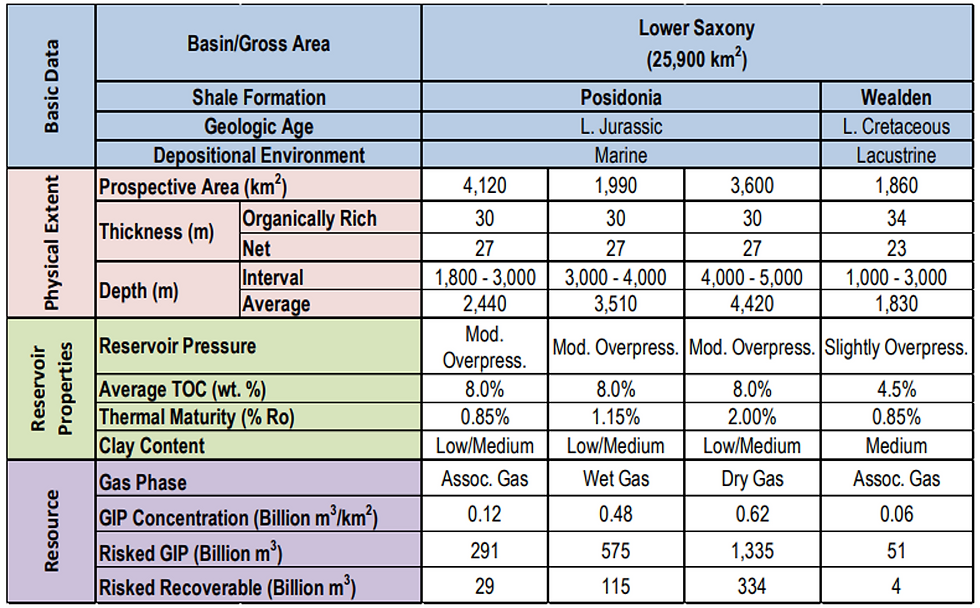

Lower Saxony contains the main shale gas resources: the marine Lower Toarcian (Jurassic) Posidonia Shale that underlies most of the basin, and the Early Cretaceous (Berriasian) lacustrine-deltaic Wealden Shale that underlies the Western part of the basin (ARI, 2013).

According to ARI, 2013: Posidonia shales contain 78 Tcf of risked gas in-place and 17 Tcf of technically recoverable gas, where the Wealden formation contains 2 Tcf of risked gas in-place and 0.1 Tcf of technically recoverable gas (risked).

Collectively, unconventional gas can have a significant impact on German energy supply. There is declining indigenous production of conventional gas in the country, and unconventional gas provides an opportunity to lower Germany's import dependence. Growing supplies of unconventional gas, led by the United States, are entering global markets. As long as there is a step-by-step approach and environmentally friendly fluids are used (to prevent the possible impact on groundwater quality of hydraulic fracturing measures), Germany has all the potential to enter the global unconventional gas markets.

Conclusions

As hydrocarbon demand in Germany is expected to increase in the future, due to the German move away from coal & nuclear energy and their strict green policy, further exploration in German SPB should be stimulated by this project, since gas has a significant role to play during the energy transition period.

Domestic shale gas development should also be further examined by specialists as the aforementioned volumes seem to be enough to delay gas imports in Germany.

My special thanks to the 1st Subsurface Oilfield Management Limited team for handing me this project and supporting me along the way. Especially to Mike Cooper, my main supervisor from 1st Subsurface, for his encouragement and patient guidance. My special thanks are also extended to Helge Kreutz and Adrian Riemer.

References

· ARI, 2013, EIA/ARI World Shale Gas and Shale Oil Resource Assessment, Available at:https://www.advres.com/pdf/A_EIA_ARI_2013%20World%20Shale%20Gas%20and%20Shale%20Oil%20Resource%20Assessment.pdf Last visited: 24/07/2021

· Deuse Klaus,2014, Is it a one-way option to supply energy from Russia? Available at: https://p.dw.com/p/1Bjbh Last visited: 24/07/2021

· Geluk Marinus,2005, Stratigraphy and tectonics of Permo- Triassic basins in the Netherlands and surrounding areas, PHD Thesis, University of Utrecht, Utrecht, The Netherlands

· Weijermars Ruud, 2013, Economic appraisal of shale gas plays in Continental Europe, Applied Energy, Volume 106, Pages 100-115, ISSN 0306-2619, Available at: https://doi.org/10.1016/j.apenergy.2013.01.025.

Comments